Stop stressing and learn practical ways for budgeting for a baby.

Are you in hustle-mode trying to buy everything your baby will need and still save for baby before you’re hit with all the expenses after your baby is born?

Maybe you’ve been working, pinching pennies, and given up spending money on yourself for months with little to show for it.

I get it, mama!

Did you know that the average cost of having a baby is $245,340?

Now, try having twins! 🙂

When I learned I was going to have twins, I knew I had to whip out a budget plan for having twins quickly! Since twins need double of everything, I had to find ways to cut things out of my life as well as find other ways to make money.

Creating a budget for a baby isn’t easy, but very possible (I didn’t go broke having twins!)!

Let’s go over 24 ways to financially plan for a baby. This will also include several (non-strenuous) ways to make extra cash on the side while preparing for baby to come!

1. Create a Capsule Wardrobe for Your Baby

First-time mommies rarely hear this, but isn’t it an awesome idea?

In fact, they usually hear the opposite. There are a ton of baby clothes you can buy, but you don’t need that.

Babies grow so fast and actually end up outgrowing most of one size of their clothes within a month or two, depending the baby.

So, why not just buy the staples and create a capsule wardrobe?

Newborns basically just need onesies. I know there are adorable cute outfits for newborns, but trust me, the amount of times you will change your newborn because of spit up or blow ups will be many!

So save the hassle – and the cash – by buying sets of onsies like these.

2. Purchase Simple Toys

Being a mother is so exciting, and watching your baby smile, coo, giggle, and laugh is such a joy.

Just remember, babies have it already built into them to be content with very simple things. And that goes for their toys too – toys your parents had and are simplistic in nature. These are the best toys for babies!

It’s not the name brand, expensive toys with all the fancy gadgets and sounds that will make your child happy. It’s you!

Now don’t get me wrong, your baby will most likely enjoy the more engaging toys later on (a few months after birth). But those toys don’t have to be purchased before your baby arrives.

3. Buy Used Items

Okay, obviously don’t buy everything used.

Think about buying gently used items, like clothing, a stroller, a diaper bag, etc. If you can, “shop” in your own closet at home and look for hand-me-downs from your older children to save money all together.

And if this is your first baby, look to your mom friends for donations! I know they will want to declutter their home from old baby clothes!

4. Buy Only What You Need

You KNOW this already, but we all need those constant reminders don’t we? Buying only what’s needed isn’t always fun or exciting but it does bring you a bit further to your goal of storing up some savings.

To get started on preparing for baby, stock up on non-baby things like batteries, cleaning supplies and make-ahead meals!

Make this your golden rule and you’ll be surprised at how much you can save!

5. Get Free Samples of Baby Items

Yes, there are actual places you can get free baby samples!

- Free baby formula – sign up to Enfamil and grab free samples of their newborn, infant and toddler formula and even nursing bottles!

- Free diapers – sign up to Pampers to get free samples including diapers!

- Free pacifier and more – sign up to Target’s baby registry and receive your welcome gift, valued over $100 with coupons and samples!

- Free diapers and wipes – sign up for a free trial of wipes or diapers with The Honest Co.

6. Use a Baby Cost Calculator to Budget

Wait, you do have a budget, right? I get it, you hear everyone talk your ear off about creating a budget and sticking to it. But the truth is, setting up a budget and abiding by it actually works when trying to accomplish the goal of saving money.

Budgets don’t have to be dull and boring either mama!

It also doesn’t mean you can never have any wiggle room to breathe or treat yourself on those days you really want to. Why not go ahead and factor in the “treat myself” expense into your budget plan?

Right now, a budget is your best friend! Actually, I wouldn’t hesitate to rank having a budget as the #1 key to impacting how much you’re able to save.

To begin use the first-year baby cost calculator to figure out the cost of having a baby for the first year.

7. Work From Home

If you work out of the home but still find it hard to save, bringing in additional income will help you save more. And working at home can benefit you in more ways then one!

Here are some quick ways to get started working at home before baby arrives!

- Sign up at Mindswarms to complete short consumer studies that pay anywhere from $50-$75 for a short amount of time. You need a PayPal account and can get paid within 24 hours of completing your study.

- Start a blog! Yes, starting a mom blog is a fun way to start making money at home! Need help starting? Check out my easy tech-free tutorial on starting a blog.

- Why not offer a service like freelance writing, Pinterest management or graphic design? If you have a skill, why not offer it on your Facebook page or on Twitter?

- Need more ideas? Here are 74 more ways to make money at home!

8. Use Cash Instead of Credit

‘What difference does this make, it doesn’t help me SAVE?’

Is this what you’re asking right now? It may seem pointless, but using cash as opposed to credit (in most cases) does have an impact on how much you spend. Cash is always much harder to part with as opposed using a credit or debit card.

Now is a great time to get use to using cash instead of credit. It will make it easier once your baby is born!

9. Buy on Clearance

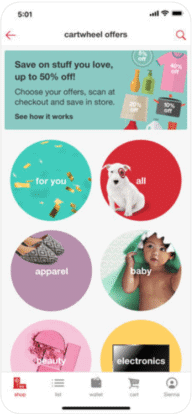

Tackle those clearance racks and take the extra time to look for sales and promotions. Sometimes Target offers free gift cards when you purchase a certain amount in baby items.

You can find out when you visit the store or from your comfy couch at home. Just look under the “Wallet” tab in Target’s Cartwheel app.

10. Use Your Old Maternity Clothes

If you have maternity clothes from an earlier pregnancy, bring em’ out of the closet.

11. Eat Out Less

Eating out is a luxury so try to limit going out or avoid it all together! You don’t want it to break the bank and defeat you by devouring what you’ve already managed to save and cut back on in other areas.

I KNOW it’s a lot harder when you’re pregnant. Especially if you suffer from morning sickness or aversions to many of the foods you normally eat. For me, during my first trimester I could barley hold anything down. And the only thing that I could? Were McDonald’s smoothies!

I know! Unhealthy and costly. Luckily my hubby was able to make me a better and healthier smoothie that saved us money when I was pregnant.

To help you curb your fast food habits, check out these budget-friendly meal ideas.

Pack a lunch from Home

Packing a lunch from home when you go to work can save you a hefty chunk of change that will add up over the weeks and months. Don’t doubt the impact of this tweak in your daily or weekly spending habits. It can make a huge difference!

Use an Instant Pot

If you haven’t made best friends with your InstantPot, you should! After your baby arrives, let me just say, it’ll come in handy for sure. An Instant pot can be especially helpful in reducing stress when you’re not up to cooking – and it’s super healthy too.

Have Friends or Family Cook For You

If the thought of chopping certain veggies and the smell of cooked food makes you cringe and gag, you can ask a friend or your husband to cook the meals for you.

If your husband works long hours (leaves early and comes back late), why not ask him to chop the veggies or meat and put them into the slow cooker for you before he leaves?

Make Ahead Meals

I was put on bedrest at 23 weeks and had to limit standing up and walking. But, I knew I wasn’t going to have the energy to cook once the twins were home.

Fortunately, my in laws prepped meals for me. If you are more fortunate than me, you can make ahead a ton of meals before baby arrives!

You’ll love yourself when you’re exhausted and have a crying baby and can’t fathom fixing dinner because you have a meal in the freezer ready to be cooked!

12. Price Compare

Is shopping for all the baby items the last thing you feel like doing? Do you just want to get it out of the way?

I know how that feels, trust me! But unless you’re getting everything for free or deeply discounted, price comparing is definitely worth your while.

So for instance, you might decide to tackle diapers one week. Decide how many packs you’ll buy. Do a little research. Look for coupons, discounts, and sales both in the store and online.

Retail Me Not is an excellent place that has a wide variety of coupons to stores that you already shop at. It’s free to browse their online coupons to save every buck you can!

You got this!

13. Skip the Changing Table

Changing your baby on the bed works just the same as a changing table. Unless the height of the changing table is an advantage to you (perhaps for medical reasons), you may want to reconsider buying one at all.

When using your bed or couch as a changing table, make sure to use a changing pad. A portable diaper changing pad is your best option as it saves you money since it’s an all-in-one.

14. Save The Unexpected Extra Income

Instead of spending the extra money you get from working at home, you can tuck it away for later to have when you find yourself in a tight spot financially. We all have those days so it’s best to plan for ahead.

Call it your save for baby fund!

15. Don’t Buy Tons Of Diapers

By now you’ve probably heard just about every other mom say, “stock up on lots of diapers,” right? It’s no secret that you’ll have to buy a lot of diapers, but they key is not to buy them all at once. And you definitely don’t want to buy too much of the same size! Your baby is going to grow so fast. Buy in bulk, but pace yourself.

16. Don’t Buy Too Many Outfits

For about the first three to six months, you’ll probably end up dressing your baby in onesies rather than formal outfits. And you can even budget for your bringing home outfit too! For my twins I used pretty onesies and I knitted their newborn hats for that extra personal touch!

So even if you’re going out quite a bit, your baby will still be spending a lot of time sleeping during the day. Cut back on the number of formal outfits you buy for your baby since they may remain in their onesie for long periods of time.

Remember, try to create a capsule wardrobe of essential pieces like onesies when you have a newborn.

17. Skip Baby Luxury Items

Cute as they are, items like house slippers, dresses, bathrobes, baby shoes, bath toys and other items are not needed at all. You can do without them.

18. Return Unwanted Gifts

Have you received two of the same gifts? Did you get something you don’t think you’ll end up using? Check the receipt for the return policy and consider returning it to get cash instead.

19. Hold Off on Binkies at First

Pacifiers may seem like such a small baby item that it’s almost not worth making this list. But anything you can save adds up, right?

Some babies just don’t take well to pacifiers at all – like my twins did – or they have a temperament that doesn’t cause you to ever consider giving them one.

My advice is to try other things to soothe your baby like using a moby wrap, a baby swing or just holding them while walking!

20. Sell Your Car

This one is a bit more on the radical side, which is why it tends to be overlooked. Carpooling or carefully coordinating the use of one car between spouses can help you budget for baby in the long run.

Selling the car definitely isn’t the best choice for everyone. Yet if you have two cars it may be worth considering (at least in the short-term).

And think about it – as a new mom, you can definitely work at home and start a blog to make money. It’s one of the best choices for moms!

21. Try Breastfeeding!

Even though this is technically an after baby is born saving money tip, breastfeeding can save you a ton of money since you’re not buying formula, bottles and sterilizers.

If breastfeeding is not an option for you, it’s okay! It’s not for everyone and if you feed your baby formula you’re still a great mother. For me, I did a mix of breastfeeding and formula feeding since I had a hard time increasing my milk supply.

22. Do Without a Phone

Can’t imagine your life without unlimited texting, calls, and internet?

The good news is that the government provides FREE phones to low-income individuals (living in the United States). Safelink is just one carrier. Check to see if you qualify. If you don’t, downgrading to a cheaper plan can still have a significant impact.

Still think this idea sounds a bit crazy? Just think of the potential savings…

Let’s say you pay $50 each month for your current phone bill. If you discontinue service, you could save:

- $150 over a 3-month period

- $300 over a 6-month period

- And $450 over a 9-month period! WOW!

23. Money Over Gifts

If asked by friends and family whether to give you gifts or money, choose money.

24. Ignore the Pressure

It can be challenging to buy only what’s actually needed and not wanted (or irresistibly cute!).

The pressure that comes from friends, family, and yes, even strangers a lot of times has to be pushed aside. Every mom and baby are incredibly different that there is no cookie- cutter buying list.

For instance, some moms would highly recommend nursing bras to other moms because it did wonders for them. But another mom could buy a few of them and never end up using one.

Save Money Before Baby Arrives

Saving for your baby’s arrival takes making wise decisions with the money you already have first. But it’s definitely possible if you’re really up for the challenge. When it comes to saving, the roadblocks are more your mindset than it is with your actual income!

You can do it mama, just keep tucking away a little bit at a time. You’ll be glad you did!

Let me know in the comments if there are any other ways you’ve found to save extra money before baby came that didn’t make this list.

And don’t forget to pin me!

Leave a Reply